I was speaking to some friends on the weekend who will going to Europe later this year, using Airbnb accommodation. I said I would not do that, given the possibility of last minute cancellation, a recent uptick in complaints on social media about painful owners, and more generally, I've always had a bit of an objection in principal to the whole concept, at least in areas with a housing/long term rental shortage. Sure, the company will promote it as being a way people who are asset rich but income poor can make money, although in many cases, they could also do it via long term rental.

I suppose I have less objection if it is a case of short term rental of part of a dual occupancy property - someone who has a granny flat in the back yard might be leery about the risk of getting a permanent tenant who is painful or annoying but difficult to get rid of under long term tenancy laws. (And local councils don't always allow permanent tenancy of such accommodation anyway.) But if you own a small apartment, or a house, in an area facing chronic long term rental shortages, keeping it for short term holiday rental is hurting your local community, and it's not as if you can't make money from long term rental.

So I went looking for how many Airbnb there are at the moment in Australia, and the numbers sound pretty high to me, even though they are way down on previous years. This report is from July 2021:

Listing numbers in Sydney fell 43 per cent from an average of 33,955 in the first quarter of 2020 to 19,257 for the same period this year. They have since dropped to 12,728, by far their lowest point since at least 2018.

The situation is not much better in Melbourne with listings down from 30,126 to 19,354 in the 12 months to March 31 this year, a decline of 36 per cent. On Saturday, there were 14,569 active short-term rental properties in the city.

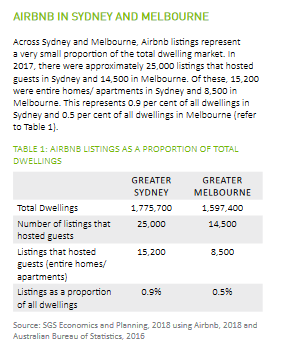

Interestingly, I see that in 2018, Airbnb had a report done to fend off complaints about its effect on the rental market. One of their points was that their numbers were too small to worry about:

But the figures in the July 2021 article would indicate that those figures in 2018 were much lower than the figures achieved in 2020.

I wonder what the figures are now, in the post Covid recovery? I can't find them quickly.

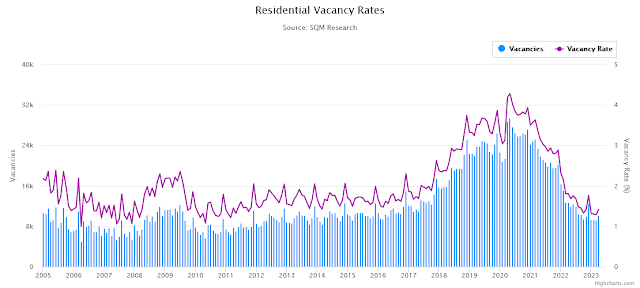

I would suspect that they would have increased since July 2021, so lets assume there are a total of 30,000 in Sydney and Melbourne, roughly 15,000 each. And how many rentals are vacant at the moment? That's easy to find:

This chart is for Sydney, and indicates roughly 10,000 vacancies, giving a vacancy rate of about 1%. this is a "tight" rental market.

Based on that, yes, adding even 10,000 Airbnb rental properties is going to double the vacancy rate - it would clearly make a substantial difference.

As this 2022 article at the ABC noted:

Across the world, major tourist destinations are moving to regulate short-stay rentals.

In Amsterdam, an entire home can only be rented out for a maximum of 30 nights per year.

While in New York, it is generally illegal to rent out an entire unit for less than 30 days. Although there are exceptions.

Meanwhile, Berlin allows you to lease out your primary residence, but it can be a bit harder to put a second home on the short-term market and you can only let a secondary residence out for a maximum of 90 days.

"Making the regulation is probably the easy part," Professor Phibbs said.

"Enforcing the regulation can be quite difficult. It's certainly resource-intensive. It sometimes involves quite long legal processes.

"It's important to have some kind of taxing regime where short-term rentals pay for the cost of that regulation through some sort of bed tax."

In Australia, New South Wales has 180-day caps in some areas, while Western Australia has been investigating a 60-day cap.

Meanwhile, Hobart is hoping to become the first capital city to place a cap on the number of short stays.

Professor Phibbs is pretty scathing:

Professor Phibbs said the number of Airbnbs in the city equated to about 9 per cent of the total rental market.

That is much higher than in any other capital city in Australia.

And Hobart's rental vacancy rate is just 0.3 per cent — the lowest for any capital city.

During the pandemic, the balance has shifted.

"When housing stock went from short-term rental back to the long-term rental market, in places like Hobart we saw a sharp reduction in rents," he said.

Professor Phibbs estimated that during COVID, rents in Hobart dropped by about 9 per cent.

Another study in Sydney by William Thackway and Christopher Pettit found rent prices in the most active Airbnb neighbourhoods dropped by up to 7 per cent.

While not all of this can be attributed to Airbnb, Professor Phibbs said the evidence was clear: You cannot have an unregulated short-term accommodation industry and a healthy long-term rental market.

"Those two things just can't co-exist," he said.

"We need some sort of regulation to limit the spread of short-term rentals so we can enable the long-term rental market to provide homes for so many households that are looking for them at the moment."

Yep, Airbnb and its ilk is a real problem, and I reckon every capital city in Australia (or even local areas with long term rental shortage) should be attacking it every way they can.

Oh, and here's an article co-authored by Professor Phipps on The Conversation from March 2023 which I hadn't read before, making many good points. People should be paying more attention, I reckon.

Anyway, I'm kind of glad my innate dislike of Airbnb can be actually justified with hard figures.

I suppose I should admit, I can think of 2 occasions over the last 20 years I have stayed at short term holiday rental of houses in Australia, through Stayz or some now defunct site. But the last time was probably 6 years ago, in what would count as a semi-country area holiday home. It's not as if Airbnb invented holiday homes: they just made short term rental in urban areas too easy.

No comments:

Post a Comment